Tax time is upon us. Here are some tips from the ATO to maximise your refund | The Business - YouTube

ato.gov.au on Twitter: "Working from home? We've extended the all-inclusive 80c per hour temporary shortcut method to 30 June 2022 to help you easily calculate your work-related expenses 🏠💻 Keep a record

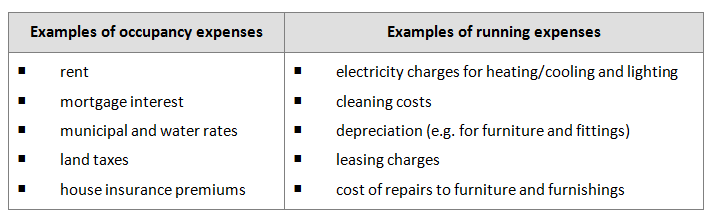

Australian Taxation Office - With so many Australians working from home to reduce the risk of coronavirus, we're making it easier to claim your expenses this tax time. From 1 March until

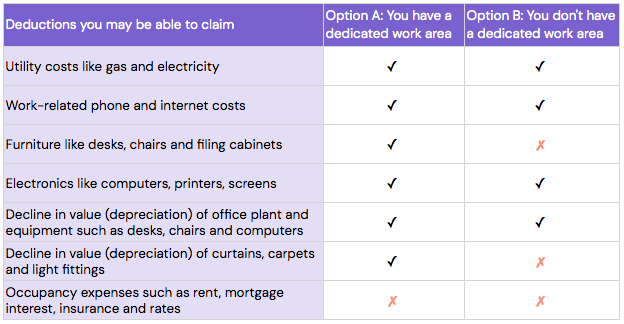

Tax return Australia: what expenses can I claim if I've returned to the office for work? | Life and style | The Guardian