How To Calculate Medicare Tax Withholding For Single Persons And Married Couples And Self-Employed - YouTube

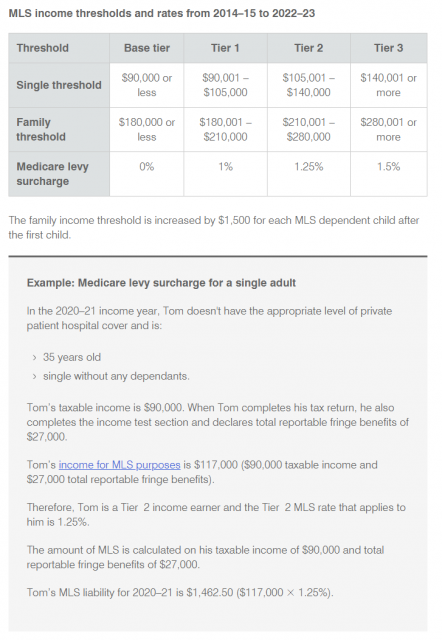

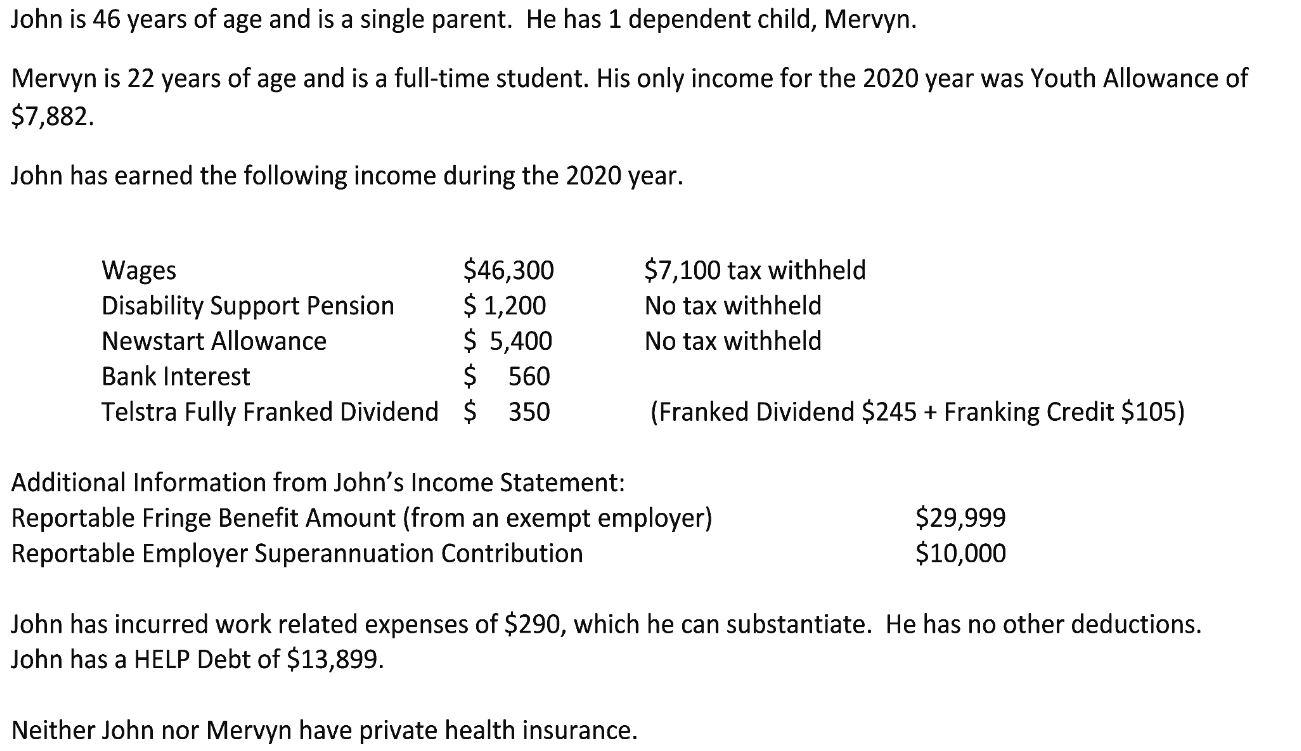

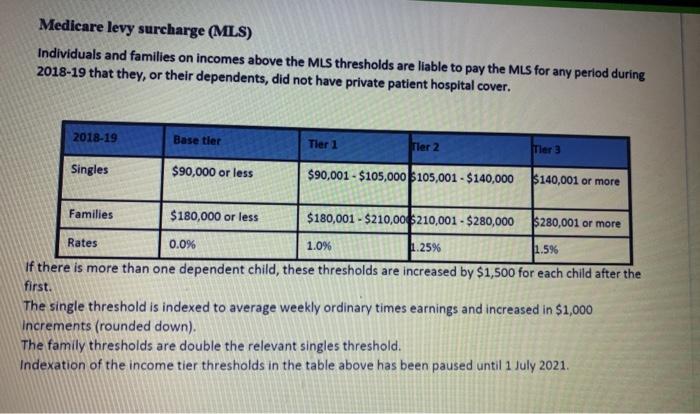

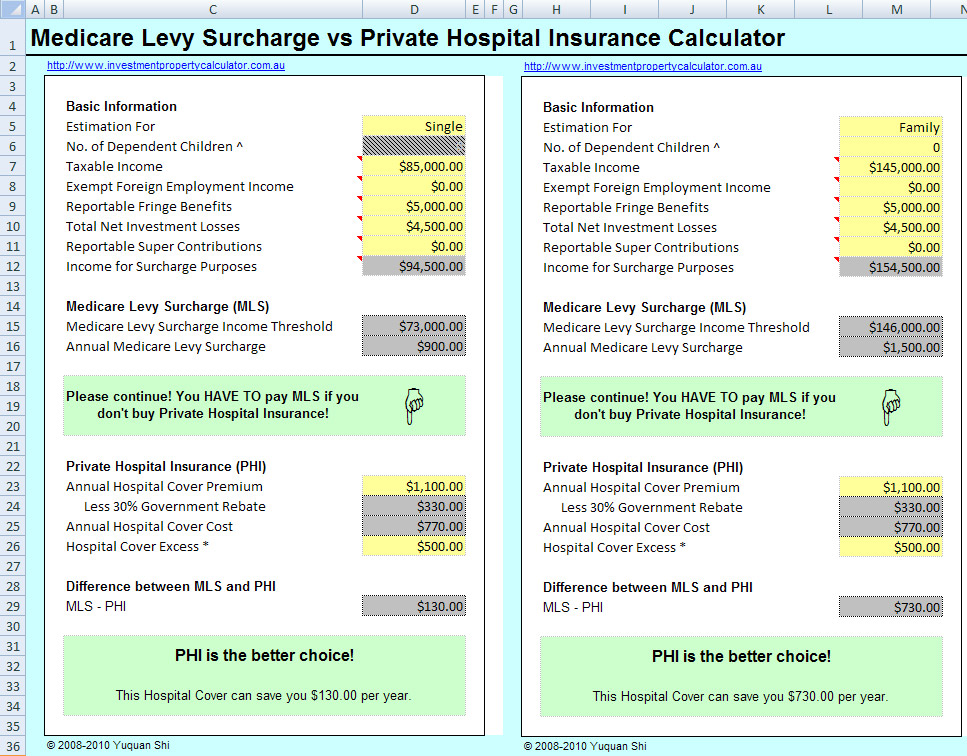

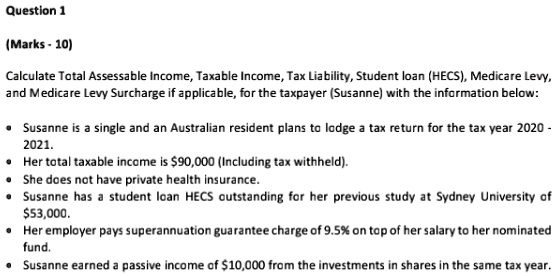

SOLVED: Please solve this question as soon as possible. Question 1 (Marks-10) Calculate Total Assessable Income, Taxable Income, Tax Liability, Student loan (HECS), Medicare Levy, and Medicare Levy Surcharge if applicable, for

![1125] Mathematics Standard 2 HSC (2021, Q22, Income Tax and Medicare Levy) - YouTube 1125] Mathematics Standard 2 HSC (2021, Q22, Income Tax and Medicare Levy) - YouTube](https://i.ytimg.com/vi/hP1Jocg2N00/maxresdefault.jpg)